|

|

Originally Posted by Renton

Actually I'll walk back my claim a little bit. I believe that the value of savings is high for everyone at every level of income, only the value is only high at lower amounts of savings. Let me try to explain.

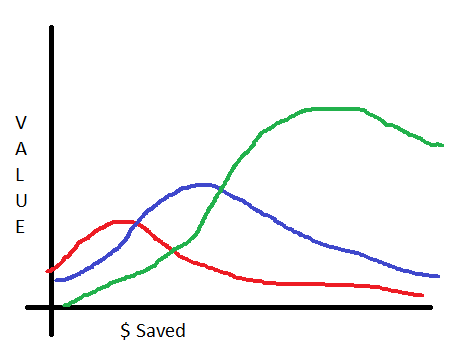

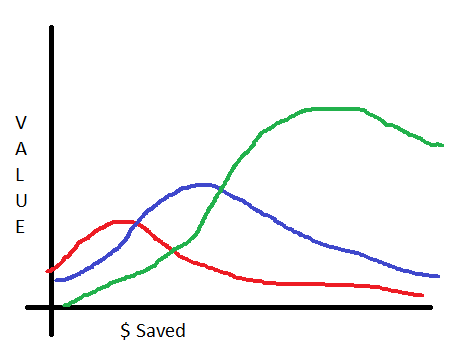

Suppose you draw a graph where the y-axis is is the amount of "value" in saving, and the x-axis is the amount of money saved.

The red line is the poor person, the blue line is the middle class person, and the green line is the upper middle class person. The benefits of saving for the poor person are in mitigating the risks of minor catastrophes like needing to fix their car or have some money stashed in case they don't get enough hours at work. Past a point though, they just need to be investing their money into increasing their human capital.

So when I said that the poor shouldn't save, what I meant was that they shouldn't save a lot as their need for money in the present is just too great.

I don't think this means the poor shouldn't save, but that they can save less. But also the marginal utility of savings for the poor is way higher than the rich. If you make 20k a year and have 5k in the bank, your choice to save up that 5k was magnitudes better for you than if you make 200k and saved 5k.

One of the best ways for the poor to become rich is merely to engage a frugal enough lifestyle that they can save/invest 5-10% of their incomes. After a lifetime, you've created a pretty big estate. If you teach your kids the same principles, they'll end up being quite rich.

In this country, and many others actually, there has been major generational shifts in income largely because of this. There is also a major age gap in income because the older tend to have accumulated savings.

|

Reply With Quote

Reply With Quote